As Open Banking continues to reshape the financial services industry, it introduces several new players who are pivotal in driving innovation, improving competition, and offering more tailored services to consumers and businesses alike. This article is the first in a three-part series that will explore these new actors, with a focus on PISPs (Payment Initiation Service Providers), AISPs (Account Information Service Providers), and PIISPs (Payment Instrument Issuer Service Providers).

Before diving into the specific roles of these players, it’s essential to understand why they exist and how they emerged as part of a broader transformation in the financial ecosystem. The concept of Open Banking was propelled by PSD2 (Payment Services Directive 2), a European regulation aimed at encouraging innovation and boosting competition by opening up the banking industry. Under PSD2, banks were required to give third-party providers access to customer account data (with the customer’s consent), thereby creating space for new types of services.

This shift represents a significant departure from traditional banking practices. Historically, banks had a near-monopoly on customer data and payment processing. Now, Open Banking has created a more open and collaborative financial environment, where new players like PISPs and AISPs can compete alongside banks, leveraging Application Programming Interfaces (APIs) to offer consumers enhanced services, from direct payments to real-time financial insights.

In this first part of our series, we’ll focus on Payment Initiation Service Providers (PISPs)—how they operate, the value they bring, and the challenges they face.

What is a PISP?

A PISP is a third-party service provider that can initiate payments directly from a customer’s bank account on their behalf, with the customer’s explicit consent. Instead of relying on traditional payment methods like credit or debit cards, PISPs allow payments to be processed directly from the payer’s bank account to the payee’s, providing a faster, more efficient, and often cheaper payment experience.

PISPs have become a key player in Open Banking because they cut out intermediaries like card networks, which have traditionally facilitated most online transactions. This direct connection between accounts results in cost savings, faster payments, and, in many cases, enhanced security through the use of Strong Customer Authentication (SCA), a PSD2 requirement aimed at reducing fraud.

Let’s take a closer look at how PISPs work and the unique advantages they offer.

How PISPs Work – an overview

PISPs leverage APIs provided by banks to connect directly with customers’ accounts. Here’s a breakdown of the payment process:

- Customer Authorization: The customer selects a PISP to make a payment. They authorize the transaction using Strong Customer Authentication (SCA), which typically involves multi-factor authentication (e.g., entering a password and verifying a one-time code sent to their phone).

- Payment Request: Once the customer approves the payment, the PISP sends a payment initiation request directly to the customer’s bank using secure APIs.

- Direct Transfer: The bank processes the payment and transfers funds directly from the customer’s account to the merchant’s or payee’s account, bypassing the need for card networks or other intermediaries.

- Confirmation: Both the customer and the merchant receive confirmation of the completed payment, typically in real-time or within seconds.

This process contrasts with the traditional card payment system, where payments must go through multiple intermediaries, including card networks, acquirers, and payment processors, each adding time and fees to the transaction.

What is the role of a PISP?

The playing field for PISPs is online payments. That is the area where the European Commission and experts see a lot of opportunities for disruption and innovation. Since the majority of online payments is made with cards today, let’s see how PISPs impact the traditional Four Corner Model for online Cards payments and what it means for corporations.

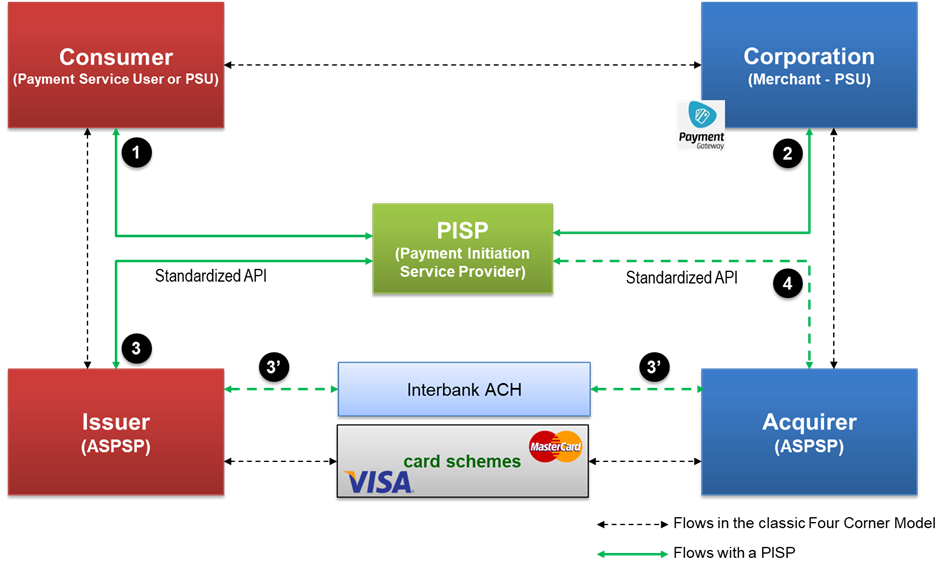

In the classic Four Corner Model, there is no PISP and the four parties exchange information among themselves. Banks use card networks for card transaction information exchange, clearing and settlement. If you want more details, you can read this article about flow exchanges for a card payment.

When a PISP is introduced, it needs to establish connections with at least three parties: the consumer, the consumer’s bank and the corporation. But it eventually needs to connect to the corporation’s bank too as we will see below.

When a PISP is introduced, it needs to establish connections with at least three parties: the consumer, the consumer’s bank and the corporation. But it eventually needs to connect to the corporation’s bank too as we will see below.

- Connection to the consumer (type of Payment Service User) – The PISP must connect with the consumer to get his consent and collect data regarding his identity and account details. Note that a Payment Service User is “a physical or legal person making use of a payment service in the capacity of payer, payee, or both”.

- Connection to the company/corporation – PISP will earn money primarily by helping corporations to get paid easier and faster. PISPs need to sign an agreement with them to initiate payments from consumers’ accounts to their favor. That requires gathering some information about the corporation and his activity (Know Your Customer and Due Diligence). To credit a corporate account and eventually notify the corporate, the PISP needs other information like the corporate account information (Account number, Bank holding the account), emails, phone numbers, etc. Note that the consumer just needs to know the corporation that receives the funds. He does not need to know the corporation account.

- Connection to the Consumer’s bank (Issuing Bank in the classic Four Corner Model) – The PISP must access the consumer’s bank to initiate the payment from her/his account. As said in the outset of this article, PISPs should use the open APIs to initiate payments from customer’s accounts. PDS2 enforces an Access to Account (XS2A) rule mandating banks (ASPSPs) to facilitate secure access via APIs to their customer accounts. This PISP to Bank communication is crucial to open Banking. Unless common technical standards are defined and widely adopted, Open banking will not become a reality. Therefore “Market participants emphasized the need for a single, common, non-ambiguous, European interface – ensuring that ASPSPs are able to communicate securely with TPPs and thus able to fulfil their regulatory obligations by TPPs access.” (See this white paper). Unfortunately the PDS2 Regulatory Technical Standards (RTS) for strong customer authentication and common and secure open standards of communication does not provide a single EU-wide API standard. On the short and middle term, this will have negative impacts on the speed to market for PISP and ultimately for theirs customers, the corporations.

Now what happens after the PISP has initiated the payment on behalf of the consumer? The consumer’s bank moves the funds to credit the corporation account through an ACH transfer (see 3’). It is simpler and cheaper than card payments requiring to use the rather expensive card networks.

- Connection to the Corporation’s bank (Acquiring Bank) – This connection is needed if the corporation decides to use the PISP solutions as well to initiate payments (expense payments made online for instance) or to refund their customers in case of dispute. Other use cases like supplier payments or salary payments are possible. Like for consumers, the PISP must have the formal consent of the corporation before initiating payments from its account(s).

PISP provide their services mainly through Web and mobile applications that PSU will access to consume their services. For e-commerce the PISP will integrate their solution into a merchant’s online checkout process to enable consumers to choose it among other payment methods. In the future we will see additional ‘pay’ buttons appearing on checkout pages alongside the traditional card payment logos.

Advantages of PISPs

- Lower Transaction Costs: Since PISPs bypass card networks and other intermediaries, businesses can avoid many of the fees typically associated with card payments. This is particularly beneficial for merchants, especially in high-volume or high-value transactions where card fees can be significant.

- Faster Payments: PISP payments are direct account-to-account transfers, resulting in faster settlement times compared to traditional methods that might take days to clear. This makes PISPs attractive to e-commerce businesses and subscription-based services, where immediate or same-day payment confirmation is crucial.

- Enhanced Security: PISPs operate under stringent PSD2 regulations, including the requirement to use Strong Customer Authentication (SCA). This adds a significant layer of security to the payment process, reducing the risk of fraud compared to traditional card payments.

- Improved Customer Experience: PISPs offer a streamlined payment process. Consumers can complete payments directly from their bank accounts without having to manually enter card details, improving the convenience and reducing friction during checkout.

Real-World Applications of PISPs

- Klarna: Although best known for its “buy now, pay later” services, Klarna also acts as a PISP, facilitating direct payments from customers’ bank accounts to merchants. This allows customers to complete their purchases more quickly and securely without the need for credit cards.

- Trustly: Trustly is a leading PISP in Europe that allows consumers to pay directly from their bank accounts. It is widely used across sectors such as online retail, travel, and even gaming platforms, providing instant, secure bank transfers.

- GoCardless: Known for enabling direct debit payments, GoCardless leverages its PISP capabilities to facilitate recurring payments for businesses, simplifying processes like subscription billing or invoicing.

Challenges for PISPs

Despite their clear advantages, PISPs face several challenges as they continue to grow within the Open Banking ecosystem:

- Building Consumer Trust: As PISPs are still relatively new, many consumers are unfamiliar with these services and may be hesitant to trust a third party to handle their payments. Educating consumers on the security and benefits of PISPs is crucial to gaining widespread adoption.

- Regulatory Compliance: PISPs must adhere to strict regulations under PSD2, including SCA and GDPR (General Data Protection Regulation) for data protection. Maintaining compliance can be a challenge, particularly for smaller fintech startups looking to scale quickly.

- Integration with Banks: While PSD2 mandates that banks provide APIs for third-party providers, the lack of universal standards across different banks can lead to integration challenges. PISPs often need to navigate different API specifications, leading to added complexity and development costs.

- Competing with Traditional Payment Methods: Although PISPs offer clear advantages, traditional payment methods like credit and debit cards still dominate the market. Convincing merchants and consumers to switch to direct bank transfers can be a slow process, especially in regions where card payments are deeply ingrained.

The Future of PISPs in Open Banking

As Open Banking continues to evolve, the role of PISPs is expected to expand significantly. Future regulations, like the anticipated PSD3, could further enhance the capabilities of PISPs by improving cross-border payments, reducing transaction times even further, and expanding their services to include more complex financial products.

Moreover, as more consumers become comfortable with the concept of direct account-to-account payments, PISPs will likely see broader adoption across industries, from retail to utilities to financial services. The potential for innovation is vast, and the growth of Open Banking globally will only accelerate the opportunities available to PISPs.

Conclusion

Payment Initiation Service Providers (PISP) have emerged as a powerful force in the payments industry, offering faster, cheaper, and more secure alternatives to traditional payment methods. As they continue to gain traction, PISPs are poised to reshape the financial services landscape by streamlining the payment process, reducing costs for merchants, and improving the overall customer experience. In the next article of our series, we will explore Account Information Service Providers (AISP), another crucial player in the Open Banking ecosystem, and how they are helping consumers gain deeper insights into their financial health. Stay tuned!