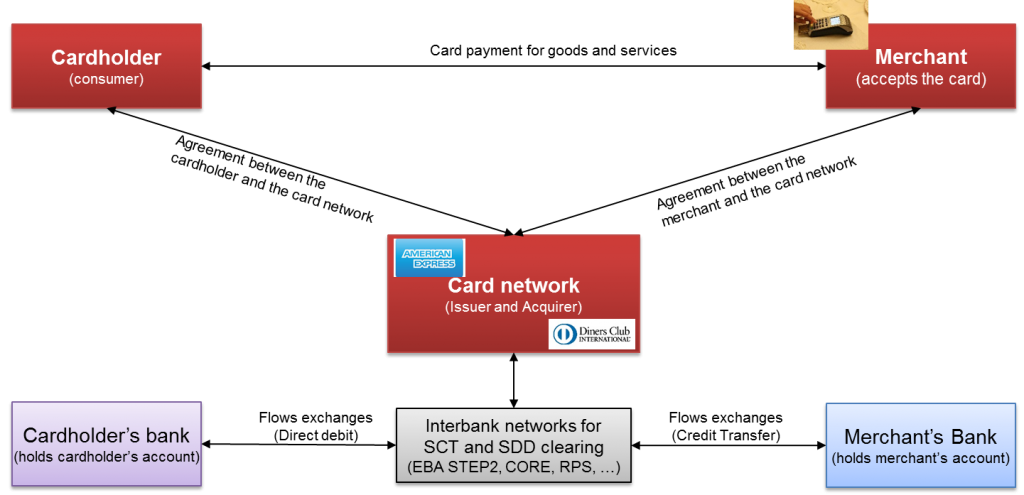

The three corner model in card payments, also known as or closed-loop model and three-party scheme, involves three main players: the cardholder, the merchant, and a third entity, the card network, responsible for the card issuance and the acquisition of transactions. In this model, the issuer (which manages the relationship with the cardholder) and the acquirer (which manages the relationship with the Merchant) is the same entity. Examples of card networks based on the three-corner model are American Express (Amex) and Diners club.

The card network provides the card to the cardholder and the POS Terminal to the merchant. The merchant may also choose to purchase a compatible POS terminal from an authorized supplier. POS Terminals are generally equipped with a chip reading device and a groove to read magnetic stripe. They must be correctly set up and configured (with the support of the supplier) before the merchant can accept card transactions. To initiate the transactions, the cardholder either inserts the card into a chip reading device or swipes it through the magnetic stripe card reader.

The cardholder and the merchant must ensure compliance with all conditions agreed with the card network when using the services and carrying out the transactions. This means for the cardholder to keep the Card and the related PIN Code secure and inform the network as soon as possible when there are concerns and issues. For the merchant, it is important to properly use the POS Terminal, take preventive measures against fraud and forward transaction records to the card network on time.

An online authorization request is not sent to the system for each individual transaction. The merchant, in agreement with the card network, defines a limit beyond which the authorization requests must be made to the network for online authorization. Below this threshold, authorizations are granted offline.

In the classic Four Corner Model, the issuer holds the cardholder’s account and the acquirer holds the merchant’s account. In the three corner model, things are different. The cardholder’s account (linked to the card) and the merchant’s account are in general held by different entities. Thus for the authorization, the network checks whether the amount of the transaction does not exceed the limits granted to the cardholder. The funds are collected from the issuer’s account once every month for all the purchases made one or two months ago. That is the reason why credit cards (that are issued by three-party scheme card networks) are more expensive than debit cards. Different types of payment cards will be presented in a future article.

At the end of the day (or at an agreed frequency), the merchant must transmit all transactions made and stored in the POS terminal to the card network. After successful processing of the transactions, the card network credits the customer’s account with the total amount of the transactions minus the fees and commissions. Note that the merchant gets the money right away but the network collects the funds from the cardholder’s account much later. The fees paid by the merchant are higher than those applied in systems based on the four-corner model.

AMEX cards are more expensive for cardholders and merchants than VISA or MASTERCARD simply because credit risks is higher. If the card network would hold the accounts for the affiliated cardholders and the merchants, it could directly carry out debits and credits on their respective accounts and that would allow them to manage the credit risk much better. But in practice, the card network does not have the status of bank and can not provide account management services. Account management of cardholders and merchants is therefore taken care of by other financial institutions. This separation between card network management and account management is called unbundling.

To illustrate, let’s take as an example the 3-corner model card network, American Express in the SEPA Area. It contracts with cardholders and merchants but does not hold their accounts. American express must therefore go through clearing and settlement systems to credit the merchants and debit the cardholders. To have a more global view of what is happening, the three-corner model can therefore be completed as depicted in the following picture. With the introduction of the SEPA space, American Express can centralize the debits and payments in one SEPA country.

Hello Sir,

I recently read an article about SIP (Single Instructing Party) for SEK Payments. This is a type of settlement model that exists in SWEDEN. In this model, the funds are settled/credited to creditor/instructed agent’s account by the central bank (RIX) using RTGS without getting any validations (structural/business rules and validity of the account) done by the instructed agent/creditor agent. Later if the transaction or credit transfer is rejected by the creditor’s bank then the central bank has to reverse the transaction.

My question is that why is it called a Single Instructing Party Model?

sorry forgot to mention that the question that I asked above because I was drawing similarities between SIP of SEK/Sweden with the three corner model of the card industry. Is there a possibility that in SIP as well the instructing and instructed parties are also same.

Please note that my comment in the previous reply stating that the credit transfer is rejected by the creditor bank and then central bank has to reverse it is wrong and does not apply to SIP model.