Payment by card has been the favourite method of electronic payment of Europeans for many years. Before the introduction of SEPA, card payments already accounted for over 30% of all transactions in the European union, a quite significant amount. Therefore card payments were naturally put into the scope of the SEPA Project. Even if Visa and MasterCard cardholders could use their cards in all countries where those networks are present (i.e. all SEPA countries), many national card schemes existed and the related cards could not be used abroad. The card networks were therefore fragmented throughout all Europe. Furthermore card payments regulation was different. The main objective behind the SEPA Cards Framework is the harmonization of card payments across the SEPA area. That should be achieved by removing all barriers and obstacles related to regulation, business or technology of card payments.

1) What is the SEPA Cards Framework?

2) What are the consequences of its implementation in Europe?

and 3) What is the EMV standard on which the SEPA Cards Framework is based?

The SEPA Cards Framework is not a new payment instrument, but an interoperability framework in the SEPA Area

With the SEPA Cards Framework (SCF), the ambition is to create an interoperability framework that establishes common operating rules for all banks, payments, users and card acceptors throughout the SEPA area. The technical, legal or commercial barriers that led to fragmentation of the card networks in Europe must be removed.

The main idea behind the SCF is the following:

[box] Any card, anywhere in SEPA. In other words, any card issued in any SEPA country must be accepted in all countries of the SEPA area. [/box] The use of a card everywhere in the SEPA area must be as easy as in the country where it was issued. This should be achieved thanks to the harmonization of protocols and materials in the SEPA countries. The payment card has to move from a national card to a European card or SEPA card. The SCF applies to general purpose cards. Store cards of limited acceptance are not concerned. But store card issuers can choose to implement the SCF rules if they wish.

The scope of SCF is limited to payments and withdrawals in euros (so not in other currencies). It is important to distinguish between the currency of the transaction and the currency of the account to which the card is linked. The account can be held in euro or another currency. But the transaction must be in euros and must have been carried out in the SEPA area. Card pricing is also harmonized in the SEPA area for cardholders, accepting merchants and banks. It is no longer allowed to have different prices in different countries within the SEPA area.

Finally, the SCF is also pursuing the goal of harmonizing and strengthening the security of card transactions. Card payments must comply with the EMV security standard. Cards must have a chip and payments should be authenticated by entering a Personal Identification Number (PIN).

In summary, the SEPA Card Framework is based on three fundamental principles:

-

Cardholders of general-purpose cards issued in a country in the SEPA zone must be able to make payments or withdrawals in euros under the same conditions throughout the SEPA zone.

-

Merchants must accept the cards regardless of the SEPA country where it was issued.

-

Card payments must be based on the EMV security standard and PIN authentication.

The implementation of SCF impacts the SEPA countries differently

France has been with the United Kingdom one of the first countries to migrate to the EMV standard. In France, migration to the EMV standard took place between 2004 and 2007. Payment cards and merchant equipment are EMV compliant. Cardholders have been using PIN for a long time and the migration to EMV has been transparent to them.

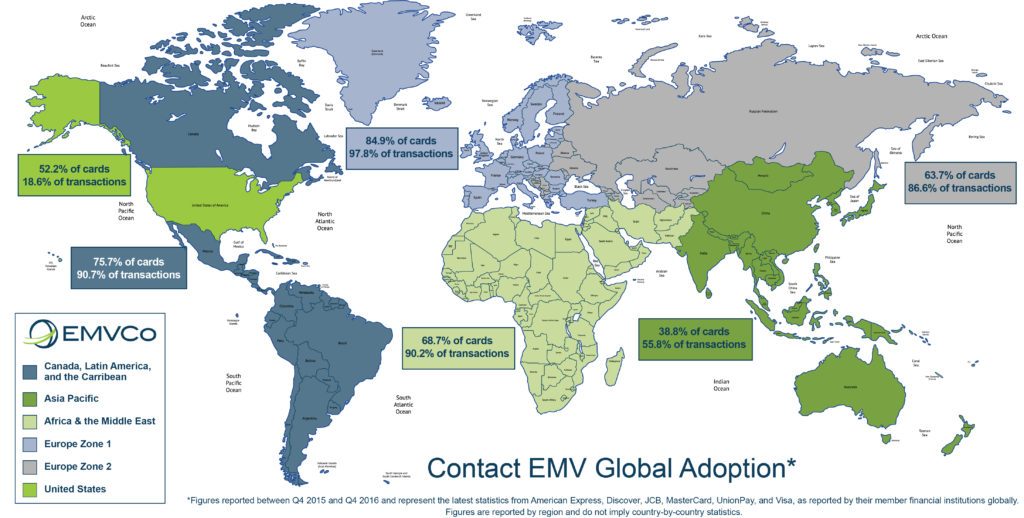

But this is not the case in many European countries that have migrated directly from the magnetic chip to the EMV chip. In those countries, the change is quite visible for cardholders, since they must now enter their PIN when using the card for Card Present purchases. The migration to the EMV standard is well advanced in Europe: 84.9% of cards and 97.8% of transactions are EMV compliant. It should be completed in next one to two years. However, the implementation of the EMV in new countries has not always been smooth. Compatibility issues have appeared each time and have been resolved, thereby improving the standard.

The maps above shows the EMV Deployment status in the world at the end of 2016. Even if we are more interested in EMV deployment in SEPA countries, it is interesting to see that there is still a lot to do in other parts of the world, particularly in Asia pacific, Africa and the United States. But what is the EMV standard? Let’s conclude this article by answering that question.

EMV, the SCF security standard

EMV stands for Europay Mastercard Visa. This is the international standard for payment card security. The EMV standard covers four areas:

-

Card – POS Terminal exchanges;

-

Acceptor – Acquirer communication;

-

Acquirer – Issuer communication;

-

The harmonization of security requirements and issuance of approvals.

The EMV standard has been designed with the objective of enabling:

-

interoperability of cards at the international level (regardless of the issuer of the card and regardless of the payment terminal)

-

verification and encryption of the personal key by the chip

-

more open management of several applications on the card: debit / credit, loyalty points, electronic purse, strong authentication

The American companies, VISA and MasterCard, at the origin of the EMV standard were strongly inspired by the French smart card. After its introduction, this standard was imposed to France, which had to abandon its own. The establishment of the SEPA Cards Framework allows the two international networks MasterCard and Visa to consolidate their positions as leaders in the card payment business.

Hi Jean,

Super write up on SEPA. Any one can understand it.

Do u have any literature on the instant payments used in Australia.

Prashanth

Hi Jean,

What payment messages are involved for Cards? Can you please advise.

Hi, I suggest you go to the ISO 20022 website and look at ISO 20022 Cards and Related Retail Financial Services messages