In the SWIFT MT940 format specifications, there are four fields for balances: F60a Opening Balance, F62a Closing Balance (Booked Funds), F64 Closing Available Balance (Available Funds) and F65 Forward Available Balance. The aim of this article is to explain the meaning of each balance field and how they are calculated.

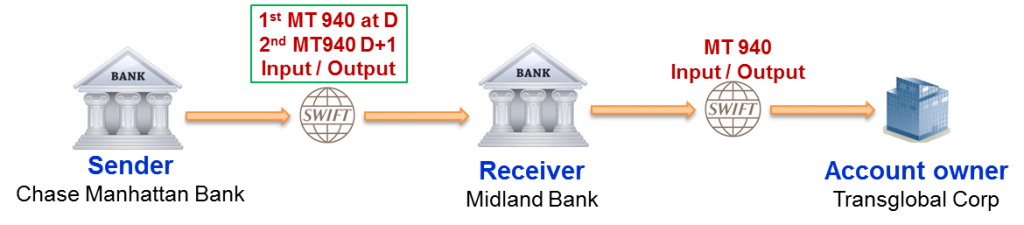

This will be illustrated through SWIFT MT940 statements sent to a financial institution authorised by account owner to receive it.

Two MT940 are sent to Midland bank authorized by Transglobal Corp to receive it. Balance fields are provided in each SWIFT MT940 format received. Considering the two messages is helpful to better understand how the balances are computed.

Balances in the first SWIFT MT940 format

The table below contains the fields that are transported in the first SWIFT MT940 format. For format of balances and line statements fields, please refer to the previous article or to the SWIFT MT940 format specifications. The main goal here is to explain how the balances are calculated. This account statement is sent on september 10.

Explanation Format Comments Sender CHASUS33 The Sender BIC appears in header block (Block 1) in the MT940 Input and in the application block (Block 2) in the MT940 Output. Message Type 940 The message type is the second field of the block 2. Receiver MIDLGB22 The Receiver BIC appears in header block (Block 1) in the MT940 Output and in the application block (Block 2) in the MT940 Input. Message Text This introduces the Text block (block 4). All the fields below are in the text block of the MT940 message. Transaction Reference Number :20:REFCHAS12345 This is the Sender's Reference specific to this MT940. It is generated by CHASUS33. Account Identification :25P:123-304958

CORPGB22 Mandatory and of format (in this case)

35x (Account)

4!a2!a2!c[3!c] (Identifier Code)

The BIC is provided here since the receiver is not the account owner. Statement Number/Sequence Number :28C:123/1 Mandatory and of format 5n[/5n] for statement number/sequence number. Only one message is sent for this statement. The sequence number 1 might have been omitted. Opening Balance :60F:C180910USD10000 USD 10000 is the opening balance on Sept. 10. 1st Transaction :61:180910C5000,NTRFNONREF//8951234

ORDER BK OF NYC WESTERN CASH RESERVE USD 5000 is a credit entry with value date Sept. 10. Related funds are available right away since we are Sept. 10. 2nd Transaction :61:180913C2500,NFEX036960//8954321 USD 2500 is a credit entry with value date Sept. 13. The funds will be available only on Sept. 13. 3rd Transaction :61:180914C400,NDIVNONREF//8846543 USD 400 is a credit entry with value date Sept. 14. The funds will be available only on Sept. 14. Information to Account Owner :86:DIVIDEND LORAL CORP

PREFERRED STOCK 1ST QUARTER 2009 Closing Balance :62F:C180910USD17900, 10000 + 5000 + 2500 + 400 = 17900. The closing balance on Sept. 10 is composed of money available on Sept.10 and money that will become available in the future. Closing Available Balance :64:C180910USD15000, Closing Available Balance on Sept. 10 = Closing Balance - Funds available after Sept. 10.

Funds available after Sept. 10 = 2500 (VD Sept. 13) + 400 (VD Sept. 14) = 2900.

So we have 15000 = 17900 - 2900. Forward Available Balance :65:C180913USD17500, Forward Available Balance on Sept. 13 = Closing Balance - Funds available after Sept. 13.

Funds available after Sept. 13 = 400 (VD Sept. 14)

So we have 17500 = 17900 - 400 Forward Available Balance :65:C180914USD17900, Forward Available Balance on Sept. 14 = Closing Balance - Funds available after Sept. 14.

Funds available after Sept. 14 = 0

So we have 17900 = 17900 - 0 Information to Account Owner :86:PRIME RATE AS OF TODAY 11 PCT End of Message Text/Trailer

We see something pretty interesting about the balances. Funds can be booked on a account with different value dates. When funds are booked with a value date in the future, the funds become available only at value date. So the account owner cannot spend the money before value date.

Balances in the second SWIFT MT940 format

The table below contains the fields that are transported in the second SWIFT MT940 format. This second statement contains only one debit entry, but it affects the other balances as you can see below. This account statement is sent on september 11.

Explanation Format Comments Sender CHASUS33 The Sender BIC appears in header block (Block 1) in the MT940 Input and in the application block (Block 2) in the MT940 Output. Message Type 940 The message type is the second field of the block 2. Receiver MIDLGB22 The Receiver BIC appears in header block (Block 1) in the MT940 Output and in the application block (Block 2) in the MT940 Input. Message Text This introduces the Text block (block 4). All the fields below are in the text block of the MT940 message. Transaction Reference Number :20:REFCHAS12654 This is the Sender's Reference specific to this MT940. It is generated by CHASUS33. Account Identification :25P:123-304958

CORPGB22 Mandatory and of format (in this case):

35x (Account)

4!a2!a2!c[3!c] (Identifier Code)

The BIC is provided here since the receiver is not the account owner. Statement Number/Sequence Number :28C:124/1 Mandatory and of format 5n[/5n] for statement number/sequence number. Only one message is sent for this statement. The sequence number 1 might have been omitted. Opening Balance :60F:C180911USD17900, The opening balance on Sept. 11 USD 17900 is the closed balance of the previous day Sept. 10 1st Transaction :61:180911D7000,S202DRS/06553 USD 7000 have been debited from the account with value date of Sept. 11. It will impact the balances. Closing Balance :62F:C180911USD10900, Closing Balance on Sept. 11 = Opening Balance on Sept. 11 - Funds debited on Sept. 11.

So we have 10900 = 17900 - 7000. Closing Available Balance :64:C180911USD8000, Closing Available Balance on Sept. 11 = Closing Balance on Sept. 11 - Funds available after Sept. 11.

Funds available after Sept. 11 = 2500 (VD Sept. 13) + 400 (VD Sept. 14) = 2900.

So we have 8000 = 10900 - 2900. Forward Available Balance :65:C180913USD10500, Forward Available Balance on Sept. 13 = Closing Balance on Sept. 11 - Funds available after Sept. 13.

Funds available after Sept. 13 = 400 (VD Sept. 14)

So we have 10500 = 10900 - 400 Forward Available Balance :65:C180914USD10900, Forward Available Balance on Sept. 14 = Closing Balance - Funds available after Sept. 14.

Funds available after Sept. 14 = 0

So we have 10900 = 10900 - 0 End of Message Text/Trailer

In conclusion, Opening and Closing balances are given for the statement date, but computed irrespective of the value dates. Forward available balances are always considered at a specific value date. To get the closing or forward available balance for a date, funds available after that date must be deducted from the total closing balance.

Simple amounts were used to make things easy and help you to follow the calculation of the different balances. If something is still unclear, please send your question through a comment. We will be happy to support.

Hi Paul, is there any restriction on number of entries a mt940 can have due to the fact that one mt940 can only have 2000 characters.

Thanks

Pramod

Hi Pramod,

One single MT940 message can have up to 2000 characters.

But you can send multiple MT940 for the same statement (See Statement Number/Sequence Number).

If the number of entries is very high, you can send as many MT940 as required and increase the sequence number with each new message.

You can theoretically send up to 99999 sequences for the same statement. That is more than enough in practice.

BR, Jean Paul

Thanks a lot Paul

Thanks for detailed explanation

I have a question

We generated MT940 statement for a date range (eg : 01-03- 2019 to 30-04-2019). It is split into multiple messages.

In all the messages, the Intermediate Account opening balance tag (Tag 60M ) is always populating date as 01-03- 2019 and Intermediate Account closing balance(Tag 62M) is always populating as 30-04-2019, whereas the balances are populating as per the corresponding opening date and closing date of transaction in a message.

Is this the correct functionality?” or 60M and 62M tags date should also update

Hi Anoop,

Sorry for not answering before. I am very busy at the moment.

To be strict, the date of the Intermediate Account opening balance tag (Tag 60M) should ideally take the date of the last (debit or credit) entry and the date of the Intermediate Account closing balance(Tag 62M) should also ideally take the date of the last (debit or credit) entry.

That totally makes sense. In reality, people do not care that much about those dates as long as the balances are correct. What truly matters in a statement are the dates of the opening and closing balances.

Dates of Closing Available Balance and Forward Available Balance are really important too. They must be correct. If you can easily fix the dates of intermediate balances, do it. Receivers won’t waste time asking themselves the same question.

Regards,

Jean Paul

Hello, can you please assist in below case.

While we send the statement that consists of two MT940 messages, the client doesn’t receve the second one. In both messages we use tag 62F showing closing balance, should it be 62M in first message? Can this be a reason that the client’s system can’t generate the second message? Also we put 64tag in both messages, can this be a reson for non receiving the second message?

Thank you.

Hello, please can I know when an account was opened on SWIFT?

Can we have multiple 62F tags on single message.