After the introduction and analysis of SWIFT cover and serial payments, we are now looking at one concrete example of SWIFT MT103 announcement and MT202 cover payment. In the previous article, we performed a detailed analysis of a MT103 announcement sent by the debtor bank to the creditor bank. Now we will consider the MT202 COV. What is the content of the message and the meaning of the different fields?

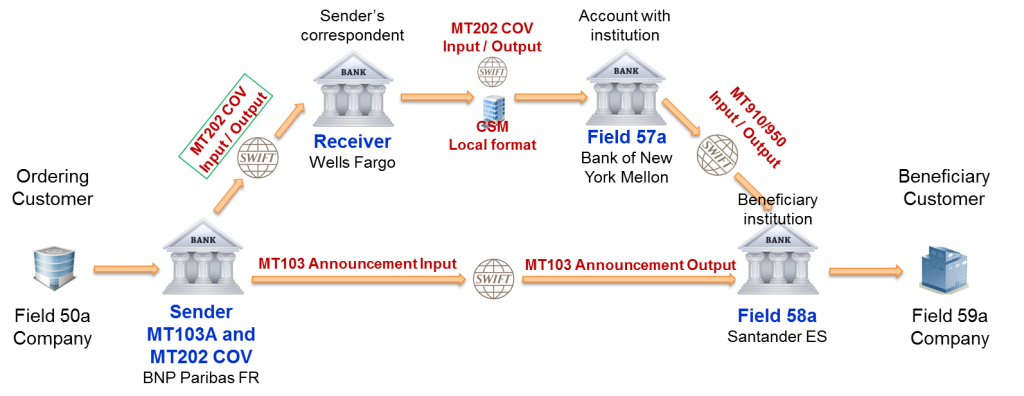

The picture depicting the messages and the different parties is below. It is the same as the one we saw in the previous article but with some small differences.

It is important to note that we are talking about the MT202 cover payment sent by BNP Paribas, not the one that is forwarded by Wells Fargo to Bank of New York. The content of the other one is a bit different and will be analysed in a later article.

Also note that in the MT202 cover payment, sender’s correspondent of MT103A becomes the receiver, the receiver’s correspondent of MT103A becomes the account with institution and the receiver of of MT103A becomes beneficiary institution.

A brief reminder of the context: A company in France, customer of BNP Paribas in Paris, wants to send payment in USD to another company in Spain, customer of Banco Santander in Madrid. Since BNP Paribas and Santander are not located in the USD currency zones, the funds transfer happens through their correspondent accounts opened with Banks in the USA. In this example, we assume that the correspondent of BNP Paribas is Wells Fargo and the correspondent of Santander is Bank of New York Mellon. BNP Paribas sends a combination of SWIFT MT103 Announcement and MT202 Cover payment messages for the transfer.

The table below contains the fields that are transported in the MT202 cover payment message. An additional column (comments) provides further explanation, so that it is easy to understand each field and what it is used for.

Explanation Format Comments Sender BNPAFRPP The Sender BIC appears in header block (Block 1) in the MT202 COV Input and in the application block (Block 2) in the MT202 COV Output. Message Type 202 The message type is the second field of the block 2. Receiver PNBPUS3N The Receiver BIC appears in header block (Block 1) in the MT202 COV Output and in the application block (Block 2) in the MT202 COV Input. In the MT103 Announcement, it is the content of the field 53A. Validation Flag 119:COV This validation flag is provided the user block (Block 3) and transported end-to-end. It indicates that the message is a MT202 Cover. Unique End-to-end Transaction Reference 121:d85a7574-863a-494d-bfbe-4084bf7704e1 This reference is provided in the user block (Block 3) and transported end-to-end. It is the End-to-end Transaction Reference (UETR) of the MT103 Announcement, that is copied unchanged to field 121 of the cover message. Message Text: General Information This introduces the Text block (block 4) and specifically the sequence A fields. All the fields below are in the text block of the MT202 COV message. Transaction Reference Number :20:202REF425782555 This is the Sender's Reference specific to this MT202 COV. It is also generated by BNPAFRPP. Related Reference :21:103REF405775 This is the Sender's Reference (:20:) of the MT103 Announcement. Value Date, Currency Code, Amount :32A:180828USD367574,90 It is mandatory and of format:

6!n3!a15d (Date)(Currency)(Amount) Account With Institution :57A:IRVTUS3N This is the correspondent of Santander in the USA, the Bank holding the USD account of BSCHESMM. In the MT103 Announcement, it is the content of the field 54A. Beneficiary Institution :58A:BSCHESMM This is the beneficiary institution which has a correspondent account in USD with IRVTUS3N. This is the receiver of the MT103 Announcement. Underlying Customer Credit Transfer Details This introduces the sequence B fields of the MT202 COV. Ordering Customer :50F:/01234567890

1/Company France SAS

2/28 RUE DENIS PAPIN

3/FR/CRETEIL 94400 Mandatory like in the MT103. This must match exactly the ordering customer field 50F provided in the MT103A. If not, beneficiary bank (BSCHESMM) rejects the message. Beneficiary Customer :59:/ES6300491800132710387658

Company Spain S.A.

Santa Hortensia 26-28

28002 MADRID

SPAIN Mandatory like in the MT103. This must match exactly the beneficiary customer field 59 provided in the MT103A. If not, beneficiary bank (BSCHESMM) rejects the message. Currency, Instructed Amount :33B:USD367574,90 Optional. When provided, it must match exactly the currency, instructed amount field 33B provided in the MT103A. If not, creditor bank (BSCHESMM) rejects the message. End of message text/trailer

Read this page on the SWIFT formatting rules and Character sets of MT Messages to get additional information and understand what 16x, 4!c and the format of the field options mean.

The second message in the combination (of SWIFT MT103 202 Cover) that is analyzed in detail below is the MT202 COV sent by BNP Paribas.

Narratives and notes on this SWIFT MT202 cover payment

As usual, we need to look at this SWIFT MT202 cover payment carrefully to really understand what is happening. The following narratives and notes allow to get a deeper understanding of the message content.

Narrative and note 1 (Main purpose of this SWIFT MT202 cover payment)

The Sender (BNPAFRPP) is instructing the receiver (PNBPUS3N) its correspondent to debit his account and send the funds to IRVTUS3N. The funds should be credited on the account of BSCHESMM (the beneficiary institution), with IRVTUS3N.

Narrative and note 2 (Meaning of COV in the MT202 cover payment)

The Block 3 of the message carries a Validation flag (Tag119) to indicate it is a cover payment. That means this MT202 is related to underlying Customer Credit transfer message. In case there is no underlying customer payment, Banks should use the normal MT202.

MT202 COV has 2 sequences in the message format: Sequence A which contains the MT202 COV payment transmission details and Sequence B which contains the MT103 message details. The sequence B (Underlying Customer Credit Transfer Details) in the MT202 COV must contain at least Ordering Customer and Beneficiary Customer information and must match exactly the ones provided in the MT103 Announcement.

Narrative and note 3 (Unique End-to-end Transaction Reference in the MT202 Cover payment)

The MT202 Cov contains exactly the same unique End-to-end Transaction Reference as the MT103 Announcement. This shows that even if the sender sends two payment messages (An announcement and a cover), it is the same transaction.

Narrative and note 4 (Fields in MT202 Cov and MT103 announcement)

- Sender of MT202 COV = Sender of MT103 = BNPAFRPP

- Receiver of MT202 COV = Sender’s correspondent 53A of MT103 = PNBPUS3N. It holds the USD account of BNPAFRPP.

- Related reference in MT202 Cov (:21:103REF405775) = Sender’s reference in the MT 103 (:20:103REF405775). It can be used to reconcile the cover with the announcement.

- Field 57A (Account with Institution) of MT202 COV = Field 54A (Receiver’s correspondent) of MT103 Announcement = IRVTUS3N. Presence of F57A indicates that sender BNPAFRPP will reach beneficiary institution through this intermediary.

- Field 58A (Beneficiary Institution) = Receiver of MT103 Announcement = BSCHESMM. This also indicates that the final beneficiary is BSCHESMM. It has an account in USD with IRVTUS3N.

This ends our analysis of this MT202 cover payment sent by BNP Paribas. We made good progress here but few questions still remain. What happens after the first MT 202 cov is received? How is it forwarded to the next party, the Account with institution? And also what are the MT910 and MT950 that we see between Account with institution and Beneficiary institution? These questions will be answered in next articles.

Perfeita explicação. Sou do Brasil e tenho ofertas semelhantes para este tipo de transferência, Posso contratar os serviços?

Hi Odilon, please write in english.

he says that he wants to hire the services in Brazil

Hello Jean Paul,

I have a question regarding transfer MT103-202.

How long it would take between Bank institution from Germany to Brunei?

Thank you

Hello Samuel,

In which currency is the transfer to be done? If it is USD, I would say 48 to 72 hours.

But it is in local currency (BND brunei dollar), it will certainly take longer.

It is easy to buy USD and you usually get in 24 to 48 hours. I do not know how long it takes to get BND.

I hope this helps. Thanks.

As I understand from your response, the time also depends on how difficult it is to buy the payment currency ? but isn’t it that the sender bank will only send out your transfer request when it has sufficient funds in its nostro account ? why is it still required to buy ?

In cross border payments, banks manage the liquidity. It is difficult to know upfront how much money is needed in foreign currency. So they collect orders until a certain time and then decide what to do. Either buy or sell or do nothing. Most of the time theb bank will buy.

Good morning Jean Paul,

Sorry for the delay. The transfer is in Euro.

Another question, do you know if the amount could be responsible for the delay?

And the money could be old by any financial controllers like IMF?

Thank you for your help.

Hi Samuel,

In cross border payments, issues can happen at many stages. If the amount is important, it may require additonal checks that can cause delay. I guess the account to be credited is in local currency. So an FX transaction must be performed to exchange EUR against BND. But base on what I saw on the Internet, this can happen pretty fast. It should be easy to find a party who wants to give BRD in exchange of EUR.

Question: After the beneficiary bank receives the funds, when should it make the funds available? How many days float does the local regulation allow?

No IMF is not involved in such transactions, but local governmental institutions might.

In the worst case, some intermediary banks may hold your money. If you have been waiting for more than 2 weeks, then there is definitely a problem. Get in contact with the sending bank to understand why money is not moving. Usually they know all the parties involved and can help.

Good luck.

Hi Jean Paul,

Nice article.I am interested in posting at each bank.Could you please elaborate the posting for above example.

Thank you for your appreciation. Posting requires an article that might be long. To be handled in the future. Too busy at the moment. Sorry. If anyone can help in the meantime, that would be really appreciated.

HI Jean,

What is the purpose of cover payment here when Bank can use only MT103 to transfer the fund to beneficiary?

Is cover payment mandatory or optional to bank to initiate?

Thanks,

Hi Parshant,

Please read the article about SWIFT serial and cover payments. And let me know if you have further questions.

Best regards,

Jean Paul

Thank you for these helpful articles. Would the analysis change if the sender in France was initially trying to pay in EUR and wanted the beneficiary in Spain to receive USD? Does the conversion from EUR to USD take place at the correspondent banks, or would there need to be a separate step for the FX transaction?

Hi Michael,

thank the appreciation! In payments, The sender decides what is the currency of the transaction and that currency can’t be changed by any intermediary.

If you initiate a transaction and provide the currency, EUR for example, that is what the beneficiary will receive. So in your case, the sender in France should provide the USD account of the beneficiary and when his bank receives the EUR transaction, an FX transaction will be performed to convert EUR to USD and credit the account. So it is a separate step indeed.

Hello Sir ,

thanks for your full detailed explain ,

Now I have SPA contract , but customer want to pay as following :

1. send money via SWIFT System .

2.After fund depostited in Receiving bank , they provide MT 103 , 202 , and black slip .

3. After providing MT103 , bank officer has to enter manually all following datain the system to identify the amount correspondent account

I. Msg input reference

II. Msgoutput Reference ( in prescence) if possible.

III.Receiving Bank officer PIN

IV.TRN

V.Receiving bank officer PIN

VI. Full MT 103 will appear on the screen and receiving bank officer shall download it to the receiving company account

VII. End transaction swift

4.upon completeion ofthis procedure, funds aredownloaded to the internal distributiom account of the receiver bank and from there to the settlement account of the receiving company

What is your opinion about that transaction ,

can you explain this in details ?? is it safe for trading ??

what is black slip , TRN , Manual MT103 , why issue MT103 ,after sending money by swift code .

I am appreciate your response thanks

I forgotto mention that , money will be sent byswift to corresponding’s receiving bank

Hi, I think there is an error in field 59, in the table, in the description details.

Mandatory like in the MT103. This must match exactly the beneficiary customer field 50F provided in the MT103A. If not, beneficiary bank (BSCHESMM) rejects the message

It should be: beneficiary customer field 59F provided in the MT103A. Is it correct?

Hi Luca,

Thank you for your careful reading! You are correct. It was a mistake. I fixed it.

Regards, Jean Paul

Can you be able to pull out the funds using only TRN ?

1/we give you TRN and pass key :you locate the funds and download it

2/Sender Need Located funds screenshot

3/Bank signed PGL (Pls no copy paste signatures..must be printed out signed in blue ink)

4/ we give the final code

5/ you release the payment to our accounts

bma.srikakulam@gmail.com

Hello Jean Paul,

Great articles!! Thanks for elaborating on such an interesting subject.

You mention that “In case there is no underlying customer payment [so no MT103 if I understand correctly] , Banks should use the normal Mt202”. Even if they are transferring funds they will afterwards credit to their clients? Aren’t Mt202 supposed to be limited to the transfer of proprietary funds between financial institutions?

Thank you!

Hello Jean Paul! Thanks for your explanation. I just want to understand what Is involved with MT103/202 Manual download. Why a Manual download of SWIFT message?

Thank you for your explanations, very helpful !

I was wondering if you had similar use cases in Correspondent banking for investigation MT messages (MT190, MT191, MT99X …).

Thank you in advance 🙂